Cut through the jargon and learn to make confident investments. Gain real-world insights into how deals are constructed on our short course, taught by the leading global thinkers in the field.

PE'On-demand digital business is the future'

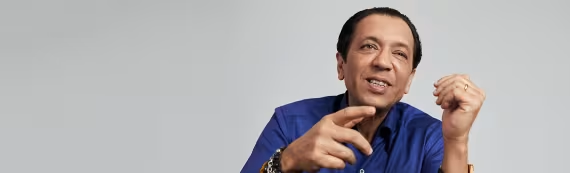

Rajeev Misra, head of SoftBank's $100bn Vision Fund, talks to Professor Florin Vasvari about the future of investing

Japanese technology conglomerate SoftBank Group has dominated the global business media since, in 2017, the Tokyo-based firm launched an ambitious $100 billion fund. Based in London, the Vision Fund is managed by SoftBank Investment Advisers and invests in high-growth technology firms aiming to disrupt sectors and industries from robotics through to artificial intelligence (AI).

The size of its investments and the frequency of acquisitions was previously unheard of in the tech investment community, dwarfing those of the then incumbent Silicon Valley heavyweights such as Sequoia, and quickly drew attention.

Rajeev Misra, CEO of SoftBank Investment Advisers and head of the firm’s Vision Fund tells Florin Vasvari, Professor of Accounting and Academic Director of the Private Equity Institute at London Business School, that he is confident growth will return to the businesses and sectors positioned to use digital innovations to roll out new services and create new value in a hi-tech world.

Florin Vasvari: How are your portfolio companies coping with the recent crisis? How did you make sure there was resilience in their business models over the past four or five months?

Rajeev Misra: Last September, we mapped out our 70 to 75 holdings, about a dozen to 15 were profitable already, but for the others, we wanted to make sure they had between 18-months to two years’ worth of cash. What is important in any crisis, is that industry leaders emerge stronger. If you look at the 2008 financial crisis, the banks that survived became substantially stronger; the real estate companies that survived became substantially larger because the competition got smaller. It’s about surviving the cycles.

We’ve set aside a significant portion of capital to help our portfolio companies as they navigate growth. Most founders love to play with 20 ideas, so keeping them focused has been a priority; focused geographically, but also focused from a cost perspective. Most of these entrepreneurs are young, in their 20s and 30s. They have seen only growth up until now. And of course, now they are being tested and are learning how to handle a cycle. We are helping them through.

“You’re as good as your team. Building up your organisation and hiring smart people is key”

Growth will come back. Take DiDi, the Chinese mobility company committed to developing autonomous driving technologies in which we own a significant minority stake. In January and February, rides were down so they were giving free rides to front-line workers. By the end of June, they were back to where they were in June 2019, in terms of rides. Ok, growth is gone for now, but business has normalised. The key is to learn, to adapt your business model, to cut your costs and to have enough runway to come out of this.

How do you think the technology in your portfolio companies will potentially create new opportunities in a post-COVID-19 world?

If you look at the world today, there is growing social unrest. I believe this is essentially because of the wealth gap between the rich and poor. It takes different forms. It can manifest as the Brexit vote, for example, but I believe these are symptoms of the problem, which is a growing wealth divide and growing income inequality. I believe technology will help level that to some extent. Take, for example, education. A lack of education can handicap a person early on and then their opportunities diminish rapidly after that. The provision of online education brings best-in-class teaching to you wherever you are in the world and it brings costs down too. Zuoyebang, an online education platform in China, has grown significantly since December to 170 million monthly active users and 41 million daily active users.

“If you look at the 2008 financial crisis, the banks that survived became substantially stronger; the real estate companies that survived became substantially larger because competition got smaller. It’s about surviving the cycles”

Life sciences will likely also benefit from digital innovation in a post-COVID-19 world. Drug discovery used to cost billions of dollars and take years. Today, advances in gene editing, genomics and agile working practices are making the process much more efficient, cheaper and effective. Telehealth such as PingAn Good Doctor, too will only accelerate and democratise healthcare as companies increasingly use AI to triage patients. Financial services will also likely benefit from technology innovation. Twenty years ago, about 35% of Americans owned stocks. Today, that number is about 60% and, thanks to a raft of low-cost and commission-free brokerage platforms, this will only increase.

The other two industries that have been affected by COVID-19, both positively and negatively, are food and entertainment. Take “dark stores” and “dark kitchens”, which are essentially replacing the 7-Eleven, you don’t need expensive real estate to have the best kitchens. Reef, the real estate firm, has dark-kitchen facilities located in 5000 parking lots across the US, many of which are located in city centres, meaning you can get cooked food delivered in under 25-minutes.

You’ve had a lot of successes. What have been your biggest takeaways from the unsuccessful investments?

For a startup to grow, a good founder has to grow the bench - the second-level management. You can have business plans and growth, but if the individual, the founder is not right, and not able to delegate, then as an investor, you will waste a lot of time and resources. Another big takeaway is that getting the execution right is key. Whatever idea you have, someone else can copy it, so you’re as good as your team. Building up your organisation and hiring smart people is key. As a long-term investor, it’s important to us to help founders grow whilst keeping a distance.

Rajeev serves as the CEO of SoftBank Investment Advisers, the investment manager to the SoftBank Vision Fund, and Board Director and Executive Vice President of Japanese SoftBank Group Corp. Previously he was a Senior Managing Director and Partner at Fortress Investment Group. Prior to that, he served as the Global Head of Fixed Income, Currencies and Commodities at UBS between 2009 and 2013 and Global Head of Credit and Emerging Markets at Deutsche Bank between 1997 and 2008.